Total nonfarm payroll rose by 177,000 jobs in April, and unemployment hovered at 4.2% — an announcement that surprised economists amid news that the U.S. GDP shrunk for the first time in three years.

“The key question now: Is this the last ‘before’ jobs report?” Appcast Economist Sam Kuhn said in a statement. “Will a contracting economy bleed into a weaker labor market?”

Daniel Zhao, Glassdoor’s lead economist, called this report “the benchmark against which we’ll measure the tariff impacts,” in part because employers may still be riding the inventory buildup that occurred before tariffs went into effect. Even May might be too early for results to show, Zhao noted.

The U.S. economy can’t run on uncertainty for much longer, however, Indeed Hiring Lab economist Cory Stahle predicted. Business and consumer confidence both seem to be souring, he said in a statement, and though the data has yet to really reflect the “whipsaw movements” in the stock market, it “will at some point.”

“So far in 2025, the market has been marked by a low firing, low hiring trend that can’t last forever — sooner or later, something will have to give,” Stahle said.

That something may very easily be worker burnout.

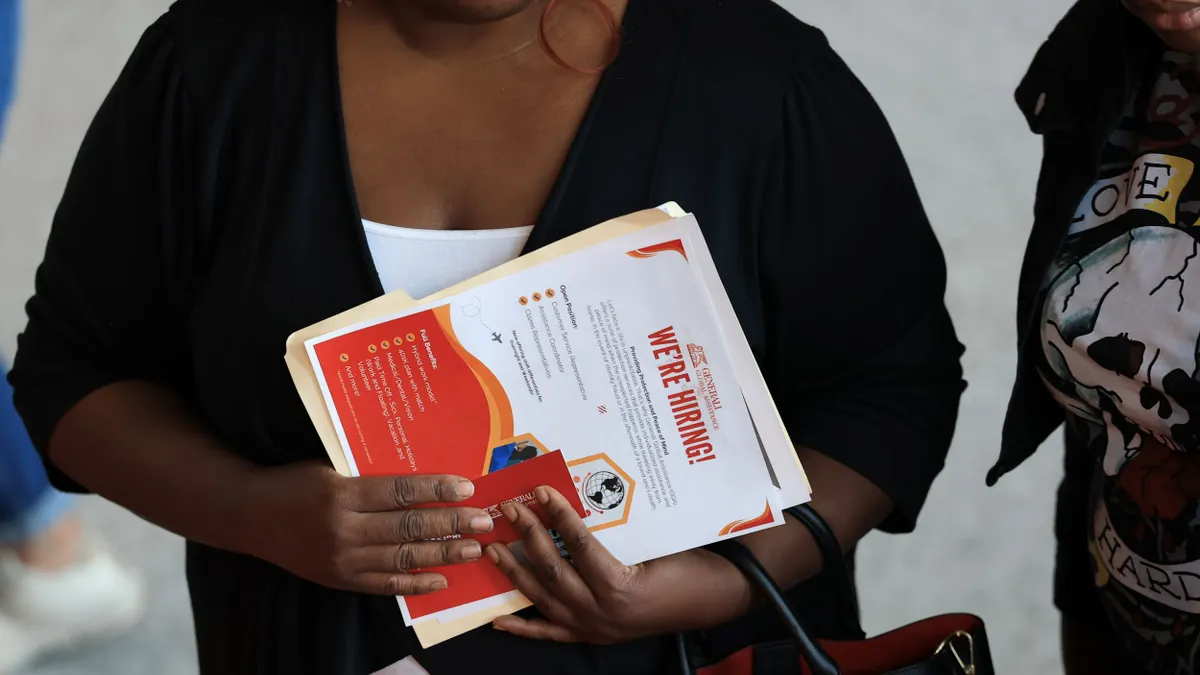

While the labor market has remained strong, Mischa Fisher, economist at Udemy, said in a statement, job hunters may have difficulty finding a job right now. Employers generally seem to be holding off on investing in hiring, Fisher said, and yet they are also wary of layoffs, afraid to put themselves in a bad position should growth return later in the year.

“This is reinforcing the dynamic where teams are expected to make do with fewer resources, and job seekers have more competition than they have had for most of the last decade landing a new job,” Fisher said.