When thinking about creating or updating your HR policies, an HR compliance checklist is a great way to help make sure your bases are covered because there's simply too much at stake. Particularly during year-end, there are many moving parts and critical deadlines your business must meet, otherwise you could face penalties. To help your company stay up-to-date, we've compiled a checklist that identifies some of the most important tasks related to payroll, HR compliance, benefits, and other important HR matters.

What Is an HR Compliance Checklist?

HR compliance is a critical part of business success, but this is a complex area with many moving parts. And with the number of employment laws and regulations on the rise, paired with the risk of penalties for non-compliance, it's important to stay organized with HR compliance matters. That's where an HR compliance checklist comes into play. This resource functions as a compass for businesses and HR teams, helping to guide them through and point them toward information and key dates, important documents, and best practices related to HR — from benefits, payroll, hiring and recruiting, and much more.

How To Keep Track of Compliance Deadlines

An HR compliance checklist is a great way to stay on top of key due dates related to applicable federal, state, and local laws and regulations. Consider that there are certain compliance matters with specific deadlines you can anticipate and will need to handle every year. A few examples of these predictable compliance deadlines include:

- Filing W-2s: Generally, by Jan. 31, employers must provide Form W-2 to employees so that they can file their federal and state taxes. A copy of each employee's W-2 must also be sent to the Social Security Administration (same deadline).

- Affordable Care Act (ACA) reporting: Applicable large employers must furnish Form 1095-C to applicable employees by March 2, 2023. The deadline for filing paper Forms 1094-C and 1095-C with the IRS is Feb. 28, 2023, or March 31, 2023, if filing electronically.

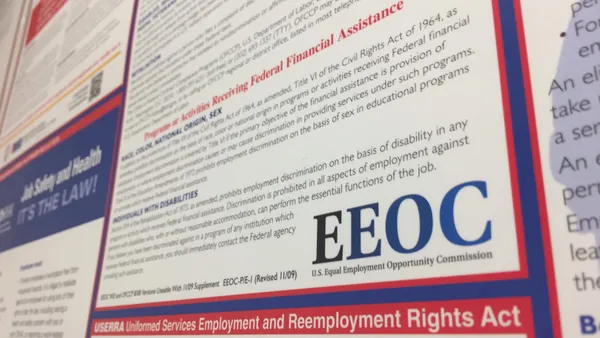

- EEO-1 reporting: Certain employers must report demographic workforce data, including data by race/ethnicity, sex and job categories. The next annual collection of data is tentatively scheduled to open in April 2023, per the EEOC.

Other deadlines may be more unpredictable or triggered by certain events, such as when you bring on a new hire or an employee leaves the organization. In such cases, knowing what's required and what your window of time is to meet your responsibilities is the best way to prepare. Regardless of the type of deadline, an HR checklist is an effective way to have visibility into your business's HR compliance-related tasks.

Taxes and Payroll Compliance

When completing taxes and payroll for year-end, reference the payroll and tax compliance checklist below to reduce the risk of mistakes during year-end:

Verify Employee Information

- Validate employee addresses. Incorrect information could delay receipt of W-2 forms for some workers and create waste for your business with the printing and mailing.

- Check your records for employees who left the company during the year to make sure their employment status was correctly updated.

Double-Check W-2s

- Verify all Social Security numbers or federal employer identification numbers (FEIN). Missing or incorrect numbers could result in a penalty by the Internal Revenue Service (IRS) of up to $50 for each W-2 returned.

- Include any taxable cash or non-cash benefits (e.g., use of a company car) on the W-2.

- If your business doesn't already do so, consider establishing a secure online portal for employees to obtain their check stubs and W-2s. This may help minimize labor and paper waste, and increase security of sensitive information.

Prepare Year-End Documents Required for Tax Filings

- CARES Act Employee Retention Credit: This tax credit was created to support employers who paid their staff throughout the pandemic. If your business didn't claim the credit last year, you may still be able to claim it. Businesses have three years after the program ends to look back at wages paid after March 12, 2020, to determine eligibility. For qualified wages paid from March 13, 2020 through Dec. 31, 2020, a credit of up to 50 percent of $10,000 in wages, annually, that were paid by companies affected by COVID-19 is available. For qualified wages paid from Jan. 1, 2021 through Sep. 30, 2021, a credit of up to 70 percent of $10,000 in wages, per quarter, paid by companies affected by COVID-19 is available.

- FICA and FUTA forms: Make a note of filing deadlines and various tax responsibilities. For example, per the IRS, if your FUTA tax liability is more than $500 for the calendar year, you must deposit at least one quarterly payment. If your liability is $500 or less in a quarter, carry it forward to the next quarter.

- Affordable Care Act requirements: Companies that must comply with the ACA must prepare and distribute 1095-C forms to applicable employees.

- Independent contractor payments: In addition to preparing employee tax forms, make sure that qualifying independent contractors, who earn more than $600 in a calendar year, receive their correct statements for tax purposes. You must now report these amounts using form 1099-NEC.

Employee Benefits Review

Open enrollment will be here before you know it. Ensure you're prepared to refresh your benefits packages and complete the following tasks related to benefits compliance.

Review Coverage Plans and Health Insurance Policies

- Group health plan renewal: Many group health insurance policies renew on Dec. 1 or Jan. 1. Review coverage plans and pricing to determine if changes are needed.

- ACA requirements: Review the provisions of the Affordable Care Act for ongoing compliance, including:

- Employer Shared Responsibility (ESR) provision under which companies employing an average of 50 or more full-time employees, including full-time equivalents, during the prior year must offer affordable and adequate medical coverage to full-time employees and their dependents or risk a potential assessment.

- IRS 2022 Employer Health Plan Affordability Threshold change: The tax year 2022 health plan affordability threshold, which is set by the IRS and used to determine if an employer's lowest-premium health plan meets the ACA affordability requirement, is 9.61% of an employee's household income (the tax year 2023 limit will be 9.12 percent).

- Open enrollment: Prepare communications with employees and schedule informational meetings.

- FSAs: If you plan to establish a flexible spending account, allowing employees to set aside pre-tax money for medical or dependent care expenses, your business needs to set up the plan and employees need to enroll before the new year.

- Review healthcare plan filing requirements and deadlines.

Gather Payroll Records

Gather payroll records if your workers' compensation policy mirrors the calendar year. An auditor may want to review payroll records in accordance with its policy period.

Compensation Policy Review

The new year is a great time to review employee compensation to make sure you are competitive with the 2023 hiring market.

Confirm Year-End Bonuses

If your business awards year-end discretionary bonuses, work with your payroll provider to issue the checks, either as a separate line item or in separate checks (additional bonus taxation may apply).

Review Wage and Hour Updates

If your applicable state or local minimum wage rate is increasing as of Jan. 1 or on a different date in 2023, ensure the updated rate is reflected for applicable employees' pay as of the effective date. In addition, review your obligations under applicable state and/or local laws with respect to wage and hour matters.

Review Updates To Wage Base Limits

Resetting wage base limits should also be a part of your year-end business compliance checklist. For the upcoming year, companies should be budgeting for the taxes they may not be paying now if employees have already met wage base limits. Wage base limits start over every Jan. 1, including federal and state unemployment tax, Medicare, Social Security, and state employment taxes. Note the 2022 increase in individual wages up to $147,000 subject to the 6.2 percent Social Security tax, also referred to as the Old Age, Survivors, and Disability Insurance (OASDI) tax.

Staffing and Training Processes

This year brought with it a number of hiring challenges, so ensure employees are trained appropriately and that you are complying with any mandated training moving into the new year.

Create or Update Your 2023 Training Calendar

Start looking ahead to next year. Consider developing a calendar of required training for managers and employees, examples of which include sexual harassment prevention training, hiring practices, workplace safety, and effective management. You may also want to schedule time to update managers and staff on COVID-19 protocols and compliance to ensure continued compliance with OSHA, CDC, and local guidance.

Review Employee Time Off

If you have a self-service portal, remind employees to review their vacation, holiday, sick, and paid-time-off banks, especially if you have a "use-it-or-lose-it" policy (where permitted) or caps on carryover amounts. If your business tracks this for employees, you may wish to notify them about their balances.

Review Your Business Continuity Plan (BCP)

Check your company's severe weather, natural disaster, and health emergency policies, and have a BCP in place in case weather, a natural disaster or health emergency impacts your business operations at year-end and through the first quarter of 2023.

Update Your Employee Handbook

An annual review of your employee handbook should be included in your year-end checklist. All new policy updates should be included in the handbook and communicated to employees. You may also want to review any remote or hybrid work policies that you may have implemented in the past few years.

Start 2023 HR Compliance on the Right Path

Preparing now can help your business run more smoothly at holiday time and beyond. Remember to use resources — including assistance with legislative and regulatory compliance, payroll, human resources, and time and attendance management. It can make preparation much easier.