Many U.S. office occupiers are achieving their attendance goals, but they’re also still trying to find ways to strike the right balance with hybrid work, according to CBRE.

Just over half, or 51% of organizations surveyed by CBRE, are expecting workers to come into the office three days a week, 9% are requiring four days a week and 17% want workers to come in full-time, according to CBRE’s 2025 Americas Office Occupier Sentiment Survey, released Monday.

While 72% of organizations reported meeting attendance goals, compared with 61% last year, there are discrepancies between expectations and actual “show-up rates” based on size. Smaller businesses, under 500 employees, more often want their employees in four or five days a week, and are more likely to be achieving their expectations than larger companies. Those with more than 10,000 employees were most likely to expect three days per week in-office and less likely to actually achieve those expectations, Julie Whelan, global head of occupier thought leadership at CBRE, said in a media briefing Friday.

The percentage of respondents saying they have achieved steady state in office use patterns declined to 61% from 64% last year, the first drop since 2022, while 38% said they actually expect office use to increase over the next couple of years.

“What that shows me is that … we are still formally in a hybrid world,” Whelan said. “However, those edges of the envelope that are getting pushed to get people into the office, just a little bit more, even among those that think they’ve pretty much achieved expectations right now, is very strong.”

The office is expected to be a core piece of corporate culture moving forward, meaning policies are important to “get this ball moving in the right direction,” said Whelan, noting 69% of respondents are measuring their attendance, versus 45% last year. At the same time, “37% are taking enforcement actions, which doesn’t seem like a lot … but that’s up from just 17% last year,” she said.

Hybrid work, space challenges

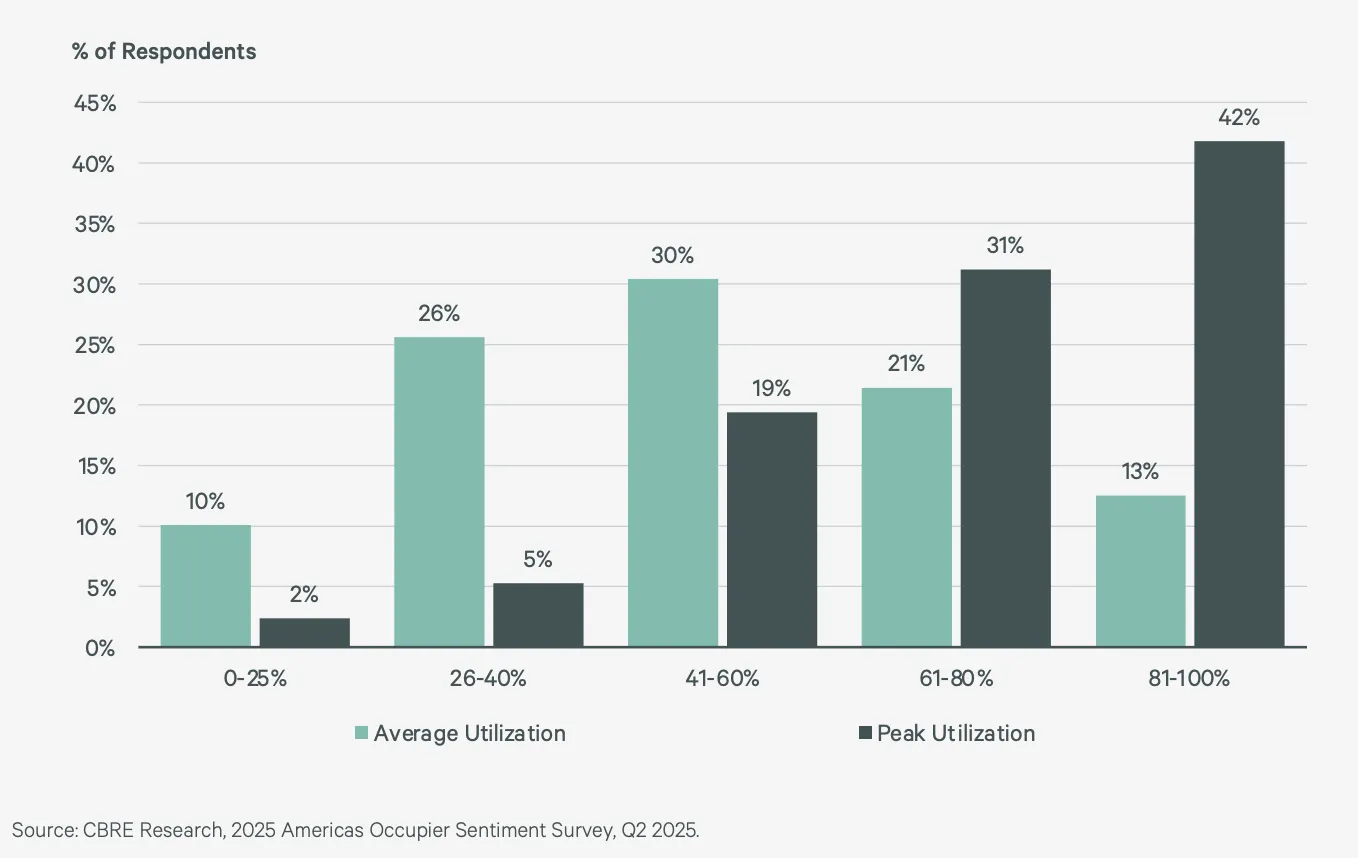

The persistence of hybrid work, which creates uneven office use throughout the week, is affecting the experience of those who come in, CBRE says in its report. Just over half say lower-attendance days create a lack of vibrancy in the office.

“On off-days, you have much less attendance, and therefore [there’s] a feeling that the office is actually less vibrant and less appealing to go to,” Whelan said.

“Nobody likes going to an empty restaurant, and nobody likes going to an empty office,” Lenny Beaudoin, executive managing director of global workplace, design and occupancy at CBRE, said during the media briefing. If fewer than 40% of people come into a space one day, those who do come in are less likely to return the next day because they had a less desirable experience, he said.

The best strategy to combat this concern is “team synchronicity,” or launching mandates that delegates team leaders to build consensus with the teams for the days they’re going to be on-site together,’ Beaudoin said.

Following a lack of vibrancy, 40% of respondents said they faced challenges with getting leaders to understand and follow through on expected workplace behaviors and protocols, according to the report. Thirty-nine percent said they are struggling to accurately anticipate and predict future space needs.

Finding quality space is a growing concern

Despite these concerns, the overarching trend shows that occupiers expect growth in their office portfolios over the next three years, Whelan said. As organizations look for certain amenities, “it means that the best spaces are doing well, and the worst spaces are not only not doing well but becoming functionally obsolete,” she said. “Many of our occupiers that are looking to expand are indicating to us in this survey that they are actually concerned about the availability of high-quality, well-located space in the future.”

This sentiment is echoed in CBRE’s 2025 U.S. Real Estate Market Outlook Midyear Review, released July 30, which found the “U.S. office market remains bifurcated, as the gap between the prime and non-prime vacancy rate widens,” Henry Chin, global head of research at CBRE, said in a statement. As of Q2 2025, the prime vacancy rate of 14.5% was 4.8 percentage points lower than the non-prime vacancy rate, with that gap expected to widen due to sustained flight to quality space and limited new supply, CBRE said in the report.

“If people are trying to save money right now as related to the office, it’s through right-sizing the office. It is not through down-grading the office,” Jamie Hodari, CEO of building operations and experience and chief commercial officer at CBRE, said during the media briefing.